Forex

WHAT IS THE FOREX MARKET?

The forex market, or FX market, is where individuals, companies, and governments all trade currencies. In simple terms, the forex market is a marketplace for buying and selling money.

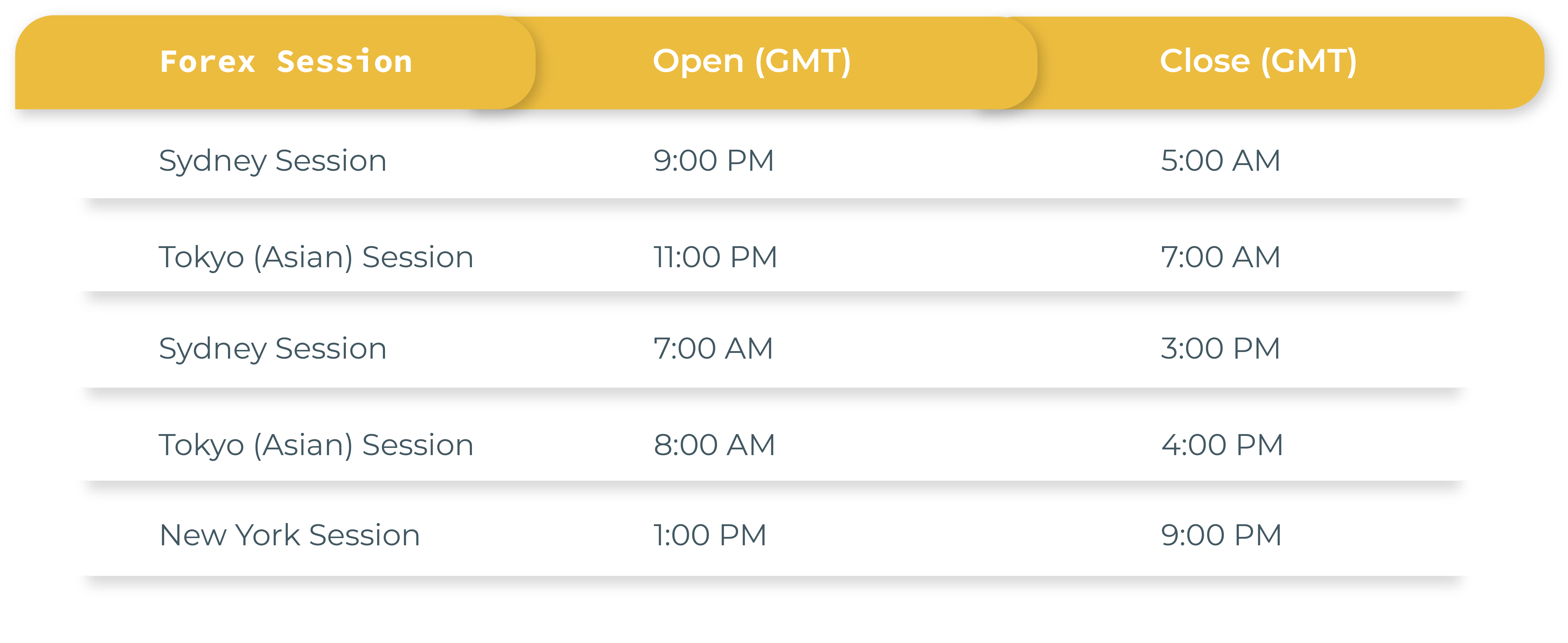

In contrast to stock and bond markets, the forex market is open 24 hours a day, 5 days a week. There is no reduction in trading volumes; rather, it simply shifts from one financial center to another. Sydney starts the day, followed by Tokyo, London, Frankfurt, and New York before returning to Sydney to repeat the process!

Compared to other international financial markets, including stocks, commodities, and bonds, the forex market is by far the largest.

The New York Stock Exchange trades an average of $22.4 billion per day, while the London Stock Exchange trades an average of $7.2 billion per day.

Those numbers seem large, don't they? Well, the forex market is even bigger, with $5.3 TRILLION in turnover!

The most appealing thing about forex trading is how accessible it is to regular people like you! People who trade the forex market from their own homes, known as 'retail traders,' require nothing more than a computer, interne t access, and a personal trading account with a broker like ECG Brokers.

THOSE NUMBERS SEEM LARGE, DON'T THEY?

Well, the forex market is even bigger, with $5.3 TRILLION in turnover!

The most appealing thing about forex trading is how accessible it is to regular people like you! People who trade the forex market from their own homes, known as 'retail traders,' require nothing more than a computer, internet access, and a personal trading account with a broker like ECG Brokers.

Is it possible to make a living trading forex alongside companies, governments, and central banks?

ECG Brokers offers a free demo account

TRADING FOREX IS EASY

Forex trading is easy to learn compared to other forms of investment. Compared to getting started in stocks, options, or futures trading, what you need to get started in forex trading is more modest.

Forex trading only requires a computer, an internet connection, and a willingness to learn! With just $250 you can open an account with ECG Brokers, a forex broker that offers a ton of free forex education.

Trade forex for a low price. As you just read, forex trading doesn’t require you to deposit tens of thousands of dollars into your account just to get started. As little as $250 can be deposited into your account to start trading forex.

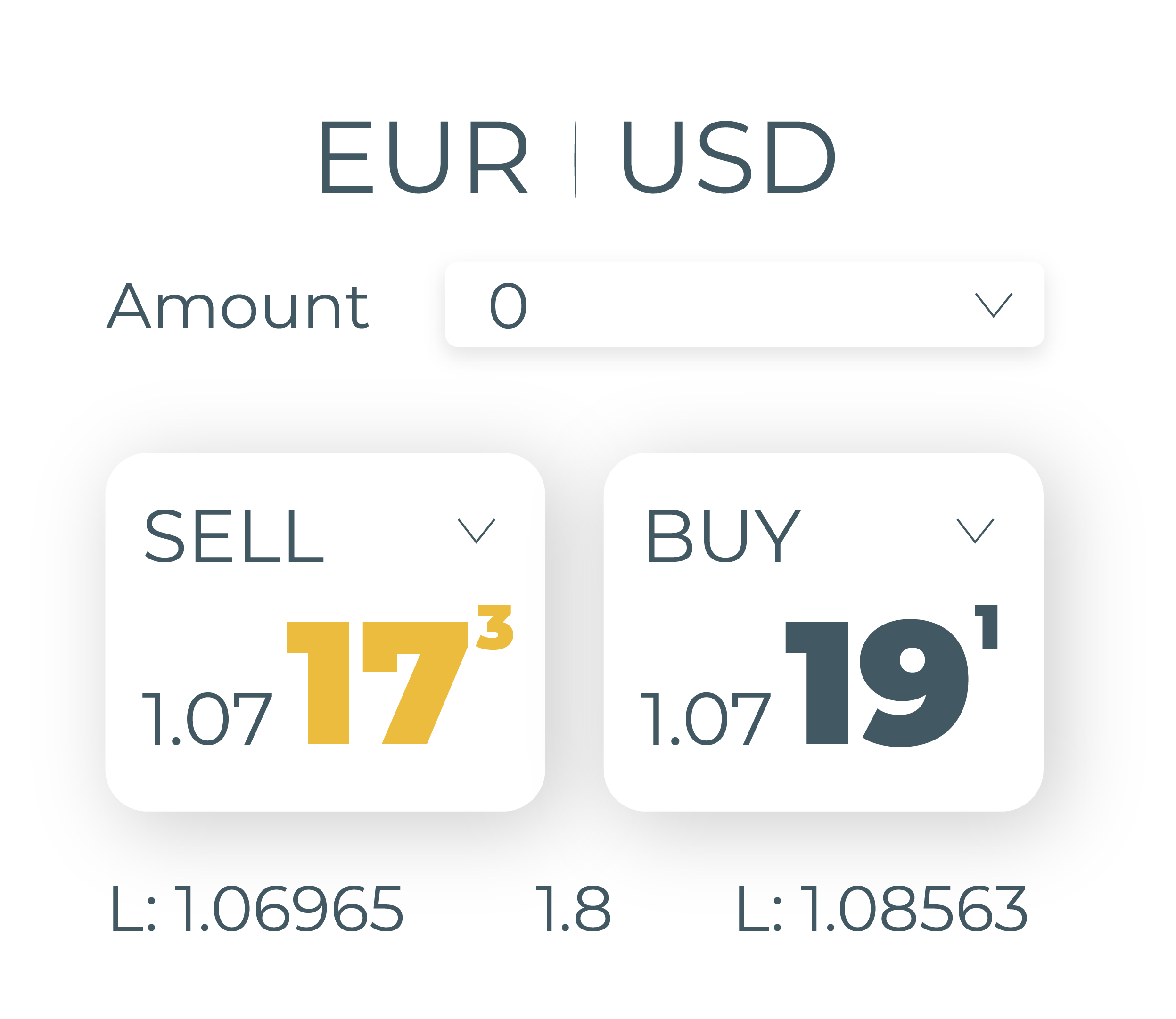

Forex trading also has an advantage over stocks, options, and futures when it comes to entry and exit costs. In other markets and instruments, you can pay huge fees for a single trade entry or exit. Unlike stocks, you can trade Forex with just 0.01 of a standard lot, paying only the spread.

FOREX TRADING ANYWHERE, ANYTIME

Forex trading is not a 9 to 5 job that confines you to your desk. With Forex, you can trade anywhere, anytime. There's no limit to where and when you can trade.

Using a computer, laptop, web browser, tablet, or mobile phone, you can access your MetaTrader5 account. An internet connection is all you need. Continually monitor the markets and never pass up an opportunity to profit!

THE WORLD’S LARGEST MARKET

There are many stock charts that you have seen that have gaps scattered throughout them. Gaps mean that you cannot enter or exit a trade at those prices since no one is interested in buying or selling. For stock traders, this adds yet another layer of risk. Forex traders do not face this challenge.

Forex is the world's largest and most liquid market. Start your trading journey with ECG Brokers today with a FREE $50,000 demo account.